This article looks at do modifications affect car insurance? Find out what counts as a car modification and how this could impact your insurance.

What Counts As A Car Modification?

A car modification is any change that is made to a car that alters the vehicle from the manufacturer's standard settings. Modifications tend to fall into two distinct categories: cosmetic modifications, and performance modifications.

Firstly, performance car modifications. These changes include altering the suspension of the vehicle, changing the wheels, increasing the car's horsepower, any turbo upgrades, re-engineering the car's engine, chip tuning and remaps, any intake or exhaust upgrades, handling modifications, lowering the suspension, any changes to fuel consumption, and modifications made to the transmission system.

Cosmetic car modifications include purely visual changes such as racing stripes or go-faster stripes, any body kit amendments, an installation of a sunroof, tinted windows, specialised paintwork, and new speaker systems

What Are The Most Popular Types Of Car Modification?

Below is a list of some of the most popular car modifications you will find:

Engine Modifications

Making a change to an engine's performance can drastically increase the speed of a car.

In the eyes of an insurance provider, this is enough to essentially classify the car as a different vehicle entirely. This can mean big changes to the amount paid.

Wheels

The addition of larger wheels and shiner alloys to a car can not only affect the handling but also make the car a prime target for thieves.

If your tyres need replacing then we would recommend using a manufacturer's approved tyres.

Tinted Windows

As long as tinted windows are on the right side of what the law would deem as legal, changing the windows on a vehicle shouldn't have a big impact on your insurance.

The added privacy given by tinted windows can even be seen as a crime deterrent by some providers.

Stickers

It might sound silly, but even a sticker can be classed as a car modification.

It can make an even bigger impact if the sticker has some kind of meaning that could be deemed controversial. Such as religious imagery.

Bodywork

The addition of anything expensive to a car can increase its value and it will need to be declared to your insurance company as soon as it is installed.

Any changes made to the body of a car can change how aerodynamics affect the vehicle and even the car's safety in the event of an accident taking place.

Spoilers

A high-quality spoiler will improve a vehicle's handling when it is travelling at high speeds. On the other hand, spoilers can also massively increase the chance of speeding.

If you do for a new spoiler to the back of your vehicle, you must ensure that it doesn't block the view from the car's rear window and is fitted safely by a qualified and trained mechanic.

Parking sensors

These sensors are designed in order to reduce the risk of minor bumps and scratches occurring on your car. These are the vast amount of claims that insurance companies deal with.

Making this kind of modification to a vehicle could mean that you are seen as a driver who takes safety very seriously. This can help to reduce your premiums.

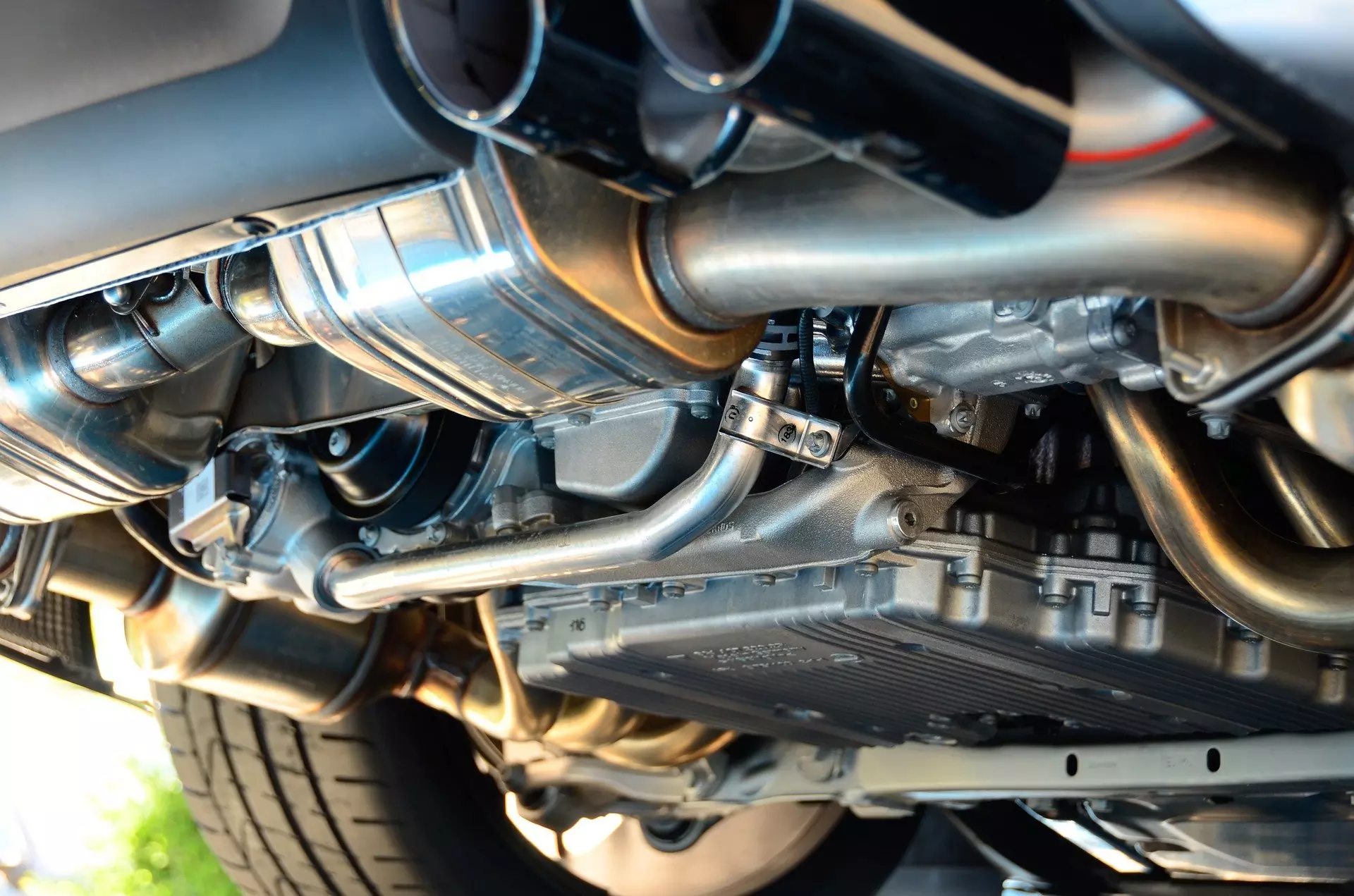

Exhaust

Changing the exhaust system on your car can enhance the vehicle's performance.

Much like with the engine mentioned earlier, any changes to the speed of a car is seen as a risk by insurance providers.

Car Insurance Price and Car Modifications

There are innumerable factors that could potentially affect your car insurance. This is why when you apply for insurance the provider will ask you many questions about any modifications you have made to your vehicle. When an insurer sets the prices of a policy, they have to take everything into account. All factors that could affect the value of the vehicle or the vehicle's chances of being in an accident or stolen must be accounted for. The idea is not for the insurance provider to charge you more, it is just to ensure that all aspects of your vehicle are covered against any potential risks.

Unless you are in contact with a specialist insurance broker, car modifications will almost always have a big impact on the factors stated above. But, no matter which insurance provider you are speaking to, it is always important for you to give all possible details about your car's modifications and be completely honest.

Below is a guide that can give you a rough estimate as to how much each car modification will add to your insurance if you are using a standard insurer.

What Modifications Affect Mainstream Car Insurance?

- Supercharging/Turbocharging - 132%

- Gear or Transmission change - 63%

- Exhaust modifications - 26%

- Air Filter changes - 25%

- Wheel arch modifications - 41%

- Complete body kit - 57%

- Skirts/Spoilers - 23%

- Light modifications - 12%

- Addition of tinted windows - 16%

- Interior seat replacement - 27%

- Roll cages or roll bars - 41%

- Dashboard modifications - 16%

- Alloy wheels - 8%

- LPG conversion - 15%

- Bonnet Scoops/Bonnet Vents - 6%

- Air conditioning - 13%

- Rear Diffuser/Front Splitter - 8%

- Intercooler modifications - 23%

- Fuel system charges - 18%

- Specialised car paintwork - 15%

- Racing stripes or badges - 9%

- Suspension changes - 25%

- Uprated brakes - 36%

What Modifications Don't Affect My Car Insurance?

Any modification you make to your car will almost always affect how much you are paying for your insurance premium. This is for various reasons. For example, a car that has been substantially enhanced will undoubtedly increase the vehicle's value.

This means that it is more valuable and costs more to replace in the unfortunate event of an accident. It can also mean that the vehicle is more desirable, and, therefore, more likely to be broken into or stolen. If you have modified your vehicle to give the engine more power and better performance, then most insurers will see this as being a higher accident risk.

There are certain modifications that won't adversely affect your quote if the modification is likely to decrease the potential risk of an accident. So for example, tow bars and parking sensors. A car with a tow bar is likely to be driven at a slower pace.

This means the driver can be more careful and is, therefore, less likely to get in an accident. The same logic goes for parking sensors, they will notify the driver when they are close to bashing into an obstacle, meaning that small accidents are less likely.

Which Car Modifications Do I Need To Declare?

Car modifications will tend to fall into one of two categories. Either a car modification will be for enhancing a vehicle's performance, or it will be to change the car's appearance.

If either of these changes has been made to your vehicle, then you must alert your insurance provider as soon as possible and declare the changes. Even if these changes have not been made by yourself, you must still declare.

If you do not declare modifications made to your vehicle, then it is likely that your insurance will be made completely void. Your claim will be refused after an event where you require financial protection or compensation.

When you are declaring all of your vehicle's modifications to your insurer, you must be careful to be as detailed and truthful as possible. This must be done so that the insurer can make a risk calculation that is as accurate as possible.

MotorHome Towbars provide cars, scooters, wheelchairs and more, so if you're interested, please reach out to us, and we can adapt your motor for your disability.

Are you looking for disability adaptions in Lincoln And Lincolnshire? We have a huge range of adaptations available and would love to discuss this with you.